When you get a debit card or check card from our Southeast Texas credit union, you won’t have to worry about going over your limit or accruing debt. Our debit cards (also known as check cards) will keep you up to date on how much money you have left in your bank account. When the amount of money deposited is depleted, your debit card will no longer be able to pull out any more.

The Best Debit Cards in Southeast Texas

The Eastex debit cards provide the convenience of cash, but the protection of a credit card in that you can track every transaction. You can dispute purchases just like a credit card, and there’s less worry of misplacing or losing cash that cannot be recovered.

There are plenty of other perks to using a debit card from our Southeast Texas credit union! To learn more about our debit or check cards at Eastex, contact us!

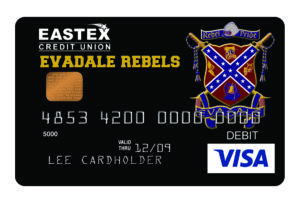

Eastex Credit Union offers Mascot Cards, show your School Spirit by getting yours today!

Keep Your Card Secure

- Treat your card like cash. Always keep your card in a safe place. It's a good idea to store your card in a card sleeve. The sleeve protects the card's magnetic stripe and helps ensure the card functions properly.

- Keep your "secret code" a secret! Your card will only work with your Personal Identification Number (" PIN"). Memorize your code. Never write it on your card or keep it with your card. Never tell your code to anyone. And never let someone else enter your code for you.

- Take your ATM receipt with you. Do not leave it at or near the ATM.

- Do not give out any information about your card over the telephone. No one needs to know your PIN; not even your financial institution.

- Report a lost or stolen card at once. Promptly report a lost or stolen card to reduce the chance that it will be used improperly. You will be issued another card.

- Check your receipts against your monthly statement to guard against ATM fraud. You get a receipt every time you make an ATM transaction. Verify each transaction by checking the receipts against your monthly account statements.

Security at Walk-Up ATM's

- Always observe your surroundings before conducting an ATM transaction. If you are driving to an ATM, park as close as possible to the terminal. Observe the entire area from the safety of your car before getting out. If you see anyone that appears to be suspicious, leave the area at once.

- If an ATM is obstructed from view or poorly lit, go to another ATM. Report the problem to the financial institution that operates the ATM.

- When possible, take a companion along when using an ATM, especially at night.

- Minimize time spent at the ATM by having your card out and ready to use. If the ATM is in use, give the person using the terminal the same privacy you expect. Allow them to move away from the ATM before you approach the terminal.

- Stand between the ATM and anyone waiting to use the terminal so that others cannot see your PIN or transaction amount. Once you have completed your transaction, take your money, card, and receipt, and immediately move away from the terminal.

- If you see anyone or anything suspicious while conducting a transaction, cancel your transaction and leave immediately.

- If anyone follows you after making an ATM transaction, go immediately to a crowded, well-lit area, and call the police.

ATM Locations

Lost or Stolen ATM Card

During office hours- 9:00 am – 5:00 pm, call the credit union at 409.276-2525 / toll-free 866.445.9622 if your ATM card has been stolen or lost.

After hours and weekends, PLEASE CALL TRANSFUND 1-888-263-3370.