Refinancing your existing vehicle loan could save you money and lower your monthly payments. You should consider refinancing if you failed to shop around for the best loan rate before buying or if your credit has improved since you purchased your vehicle. Refinancing at a lower rate would reduce the amount of money you pay in interest over the life of the loan. For example, if you have a $20,000 loan at 13% interest and term of 72 months and you refinance the loan at 8%, you save $3,676 over the life of the loan. In this scenario, your monthly payments would also decrease from $400 to $350.

Refinancing is also a good idea if you want to change the term of the agreement, or how long you will be paying the loan back. You can refinance to pay the loan back in a shorter amount of time, or if you need your money to stretch a bit further each month, you may be able to extend the life of the loan. If you refinance at a lower rate and continue to make the same monthly payments, you can shorten the length of the loan and pay less interest. In the above scenario, refinancing at 8% and continuing to make payments of $400 each month, would save you an additional $928 in interest.

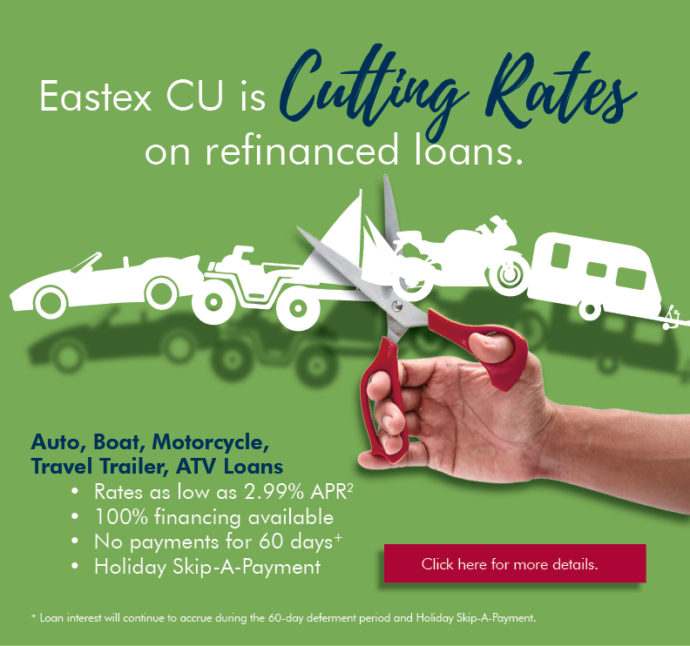

If you have an existing loan on a new or used car, boat, motorcycle, RV, or ATV from another lender, refinancing with Eastex could be a smart financial decision. In addition to saving you money on your loan, we also offer affordable GAP insurance and debt protection policies to make sure your vehicle is protected. Our friendly loan specialists help make refinancing a vehicle quick and easy. There has never been a better time to refinance with us, especially since we are cutting our rates.

Eastex is Cutting Rates on Refinanced Loans

If you are ready to save money on your car, boat, motorcycle, RV, or ATV loan, Eastex is ready to help. For a limited time, Eastex Credit Union will cut your interest rate when you refinance your existing vehicle loan from another lender. Let us handle your refinance so you can put extra money back in your pocket each month.

Refinance your New or Used Auto, Boat, Motorcycle, RV, and ATV Loans

- Rates as low as 2.99% APR

- 100% financing available

- No payments for 60 days

- Holiday Skip-A-Payment

Refinancing with Eastex CU could lower your interest rate by up to 5%!

Current Rate New Eastex CU Rate

4.00% APR 2.99% APR

8.00% APR 3.00% APR

13.00% APR 8.00% APR

Hurry in! This offer expires July 15th! Simply bring in proof of the stated interest rate from your current lender to any of our branches. The interest rate is typically printed on your coupon book, loan statement, or purchase sales agreement. To speak to one of our loan specialists, give us a call at 866.445.9622.